Build Real Financial Confidence Through Structured Learning

Our savings program runs from September 2025 through March 2026. Over six months, you'll work through practical modules that cover everything from emergency funds to long-term wealth building. We focus on real strategies that actually work in Australian conditions.

Secure Your Spot

How the Program Actually Works

We break down complex savings concepts into manageable phases. Each builds on what you learned before, so nothing feels overwhelming or disconnected from your actual financial situation.

Foundation Building

Start with the basics. We'll help you understand where your money actually goes each month. No judgment, just clear tracking methods that reveal patterns you might have missed.

6 weeksEmergency Fund Creation

Build your safety net properly. You'll learn different approaches based on income stability, family size, and personal risk tolerance. We cover realistic timelines too.

8 weeksGoal-Based Saving

Short-term needs deserve different strategies than long-term plans. We'll show you how to balance both without sacrificing your current quality of life unnecessarily.

6 weeksInvestment Basics

Once you've got solid savings habits, we introduce simple investment concepts. Think index funds and superannuation optimization—nothing exotic or risky.

5 weeksTax-Smart Strategies

Australian tax law offers some legitimate advantages for savers. We'll walk through deductions, offsets, and timing strategies that can boost your savings rate.

4 weeksLong-Term Planning

You'll create a personalized roadmap that extends beyond the program. This isn't about rigid rules—it's about building flexibility into your financial future.

3 weeks

Our Teaching Methods

Weekly Live Sessions

Every Tuesday evening at 7pm AEST. These aren't lectures—they're working sessions where we tackle real scenarios. Bring your questions and your actual numbers if you're comfortable sharing them.

Practical Exercises

Between sessions, you'll complete short assignments using your own financial data. We provide templates for budgets, tracking sheets, and goal calculators that you can keep using after the program ends.

Small Group Support

You'll join a cohort of about 15 people. Most find the peer perspective valuable—everyone's dealing with different income levels and challenges, which makes the discussion richer than you'd expect.

Resource Library

Access remains open after the program concludes. You'll have recorded sessions, updated worksheets, and case study examples that reflect current Australian economic conditions throughout 2025 and 2026.

Who'll Be Teaching

Our facilitators come from different financial backgrounds. What they share is practical experience helping Australians navigate money decisions without the jargon or unnecessary complexity.

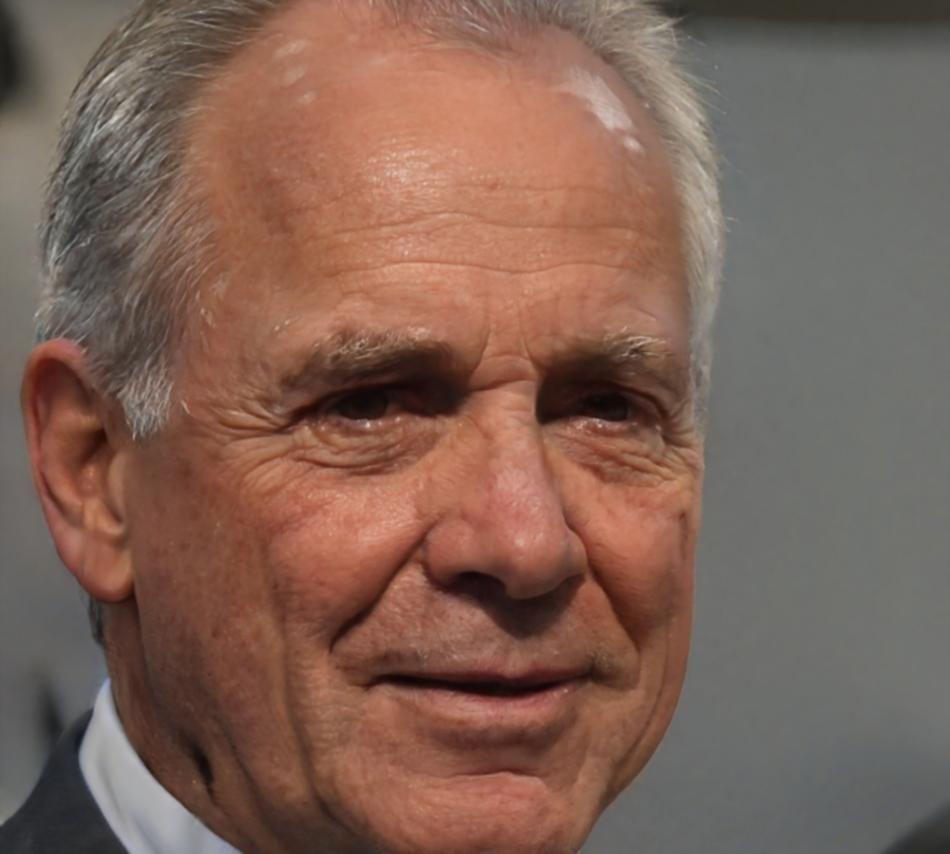

Lachlan Dermott

Lead Instructor

Spent 12 years in retail banking before shifting to education. Lachlan focuses on helping people build emergency funds that actually match their lifestyle and risk profile.

Rhys Meldrum

Investment Module

Covers the basics of passive investing and superannuation strategies. Rhys worked in financial planning for eight years and now teaches simple, low-cost approaches to wealth building.

Vincent Khoury

Tax Strategy

Former accountant who specializes in individual tax optimization. Vincent keeps things practical—he'll show you legitimate ways to keep more of what you earn without complicated structures.